Future Property Price Predictions in Gurgaon (2026–2030)

The Gurgaon real estate market continues to mature into one of India’s most dynamic property destinations. Between 2026 and 2030, property prices in this key NCR corridor are expected to witness steady appreciation driven by strong infrastructure growth, rising demand from end-users and investors, and the emergence of premium developments by reputed builders. In this outlook, we explore future Gurgaon property price predictions, key demand drivers, and how marquee projects such as Sobha Realty, M3M GIC, Emaar Serenity Hills, and Central Park Flower Valley are shaping the city’s investment landscape.

Why Gurgaon Remains Attractive for Property Investment

Gurgaon’s strategic location, strong corporate presence, improving connectivity via expressways and metro extensions, and lifestyle-oriented neighbourhoods continue to attract buyers from across India and abroad. With ongoing enhancements to Dwarka Expressway, NH-48, and metro connectivity, Gurgaon has become a preferred location not just for luxury homes, but for mid-segment and integrated township living. This broad appeal is a key reason why projections for 2026–2030 remain optimistic.

Developers like Sobha Realty have already set new benchmarks with quality construction and thoughtful design, attracting buyers who value long-term growth and brand credibility. At the same time, premium projects under the M3M GIC umbrella are generating significant investor interest due to strategic locations and comprehensive lifestyle offerings.

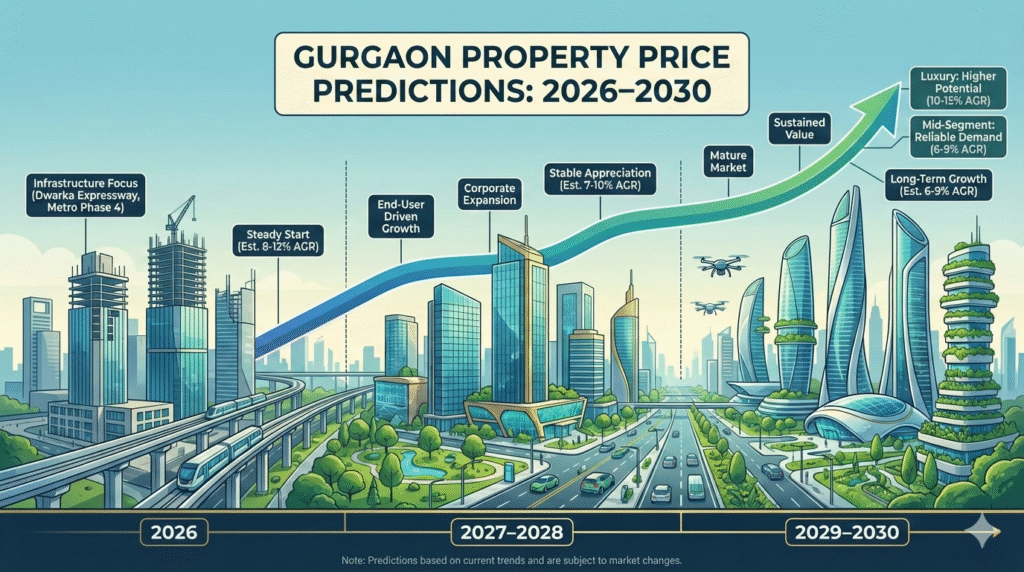

Property Price Trends: 2026–2030

Steady Growth, Not Sudden Spikes

Unlike short-lived real estate booms, Gurgaon is expected to witness steady price appreciation between 2026 and 2030. Moderate and consistent growth is healthier for sustainability, indicating stable demand and confidence among buyers. While price movements will vary by micro-location, the overall trend points toward continued growth, especially in areas benefiting from new infrastructure and branded developments.

Developments such as Emaar Serenity Hills, with their emphasis on wellness, open spaces, and premium planning, are driving value in peripheral sectors. Projects like Central Park Flower Valley are also contributing to resilient price performance due to township-level planning and enhanced lifestyle amenities.

The Role of Infrastructure in Price Appreciation

Connectivity remains one of the strongest drivers of property prices. Over the next few years:

Dwarka Expressway is expected to significantly reduce travel time to Delhi and IGI Airport, making sectors along its corridor more desirable.

Metro network expansions are set to improve accessibility across Gurgaon and NCR, shrinking distances to employment hubs and business centres.

Areas near these transport corridors have already recorded better price resilience. In such locations, branded projects from developers like Sobha Realty and M3M GIC are expected to outperform broader market trends due to their placement in well-connected nodes.

Premium Developments: Influence on Price Predictions

Sobha Realty – Quality That Commands Value

Sobha Realty has built a reputation for meticulous planning and luxury craftsmanship. Projects under this brand typically command a price premium due to strong quality perception, trust among buyers, and long-term durability. As demand for premium homes grows, Sobha Realty properties are likely to show above-average appreciation between 2026 and 2030.

With corporate relocations, dual-income families, and NRIs increasingly looking for branded, secure living options, homes by Sobha Realty are expected to remain in high demand.

M3M GIC – Strategic Locations & Lifestyle Appeal

M3M GIC projects combine strategic placement with comprehensive amenities that appeal to modern residents. These developments often feature lifestyle-oriented planning, retail integration, and community-focused spaces, all of which add to long-term value.

Between 2026 and 2030, M3M GIC addresses in Gurgaon are predicted to benefit from sustained investor interest, especially as infrastructure improves and rental demand increases.

Emaar Serenity Hills – Wellness Meets Premium Living

Emaar Serenity Hills is positioned as a premium wellness-centric residential destination. As buyer preferences shift toward health, green living, and expansive open areas, such projects are expected to outperform basic supply in terms of price growth.

Wellness continued to be a priority after global lifestyle shifts, and Emaar Serenity Hills is strategically positioned to capture this sustained demand through thoughtful design and premium finishes.

Central Park Flower Valley – Township-Level Advantage

Central Park Flower Valley exemplifies integrated township growth, combining residential, recreational, and community spaces within a single ecosystem. Townships tend to hold value well due to self-sustained amenities, internal connectivity, and lifestyle diversity.

Between 2026 and 2030, Central Park Flower Valley is projected to deliver strong appreciation, especially as more families look for holistic living environments rather than isolated housing complexes.

Investor vs End-User Demand: What’s Driving Prices?

End-User Demand:

Increasingly, buyers are seeking homes that offer comfort, lifestyle amenities, security, and future growth potential. This preference supports steady price growth in premium addresses and branded developments.

Investor Demand:

Investors are focused on areas with strong rental prospects, upcoming infrastructure, and reputed developers. Properties from Sobha Realty, M3M GIC, Emaar Serenity Hills, and Central Park Flower Valley tick these boxes and are expected to continue attracting capital between 2026 and 2030.

Price Forecast: Sector-Wise Expectations

While exact figures vary by sector, the following trends are anticipated:

Established premium nodes (near expressways and metro lines) will see consistent growth.

Peripheral sectors with upcoming infrastructure will catch up as accessibility improves.

Branded developments will generally command a premium over average market rates.

Addressing key lifestyle needs, connectivity improvements, and smart township planning will be instrumental in shaping property prices.

Conclusion: Gurgaon Real Estate Poised for Growth

The Gurgaon property market forecast for 2026–2030 shows promising, sustainable appreciation. Steady price growth, backed by strong demand, infrastructure expansion, and premium developments by builders like Sobha Realty, M3M GIC, Emaar Serenity Hills, and Central Park Flower Valley, presents compelling reasons for both buyers and investors to stay engaged.

Whether you are looking for a long-term investment or a dream home, Gurgaon’s evolving real estate landscape continues to offer diverse opportunities—and the next few years are expected to reinforce its position as a top property destination in India.