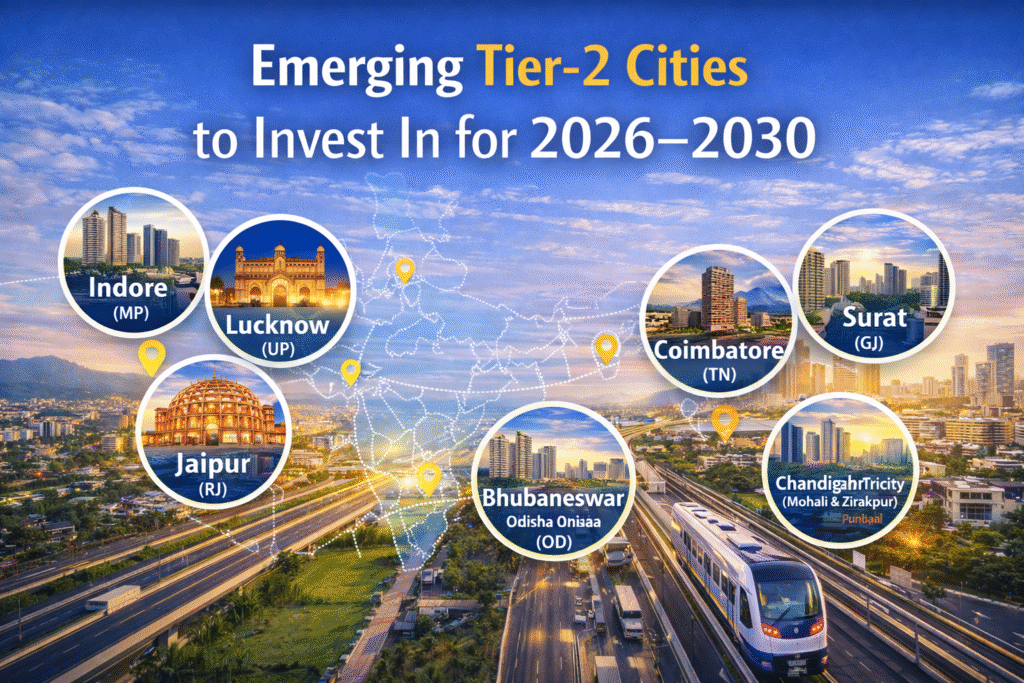

Emerging Tier-2 Cities to Invest In for 2026–2030

As property prices in Tier-1 cities continue to rise, investors are increasingly shifting focus to India’s Tier-2 cities. Between 2026 and 2030, these cities are expected to deliver strong capital appreciation, improving rental yields, and long-term growth—driven by infrastructure development, job creation, and urban migration.

If you’re planning smart real estate investments for the next decade, here’s a detailed look at the top emerging Tier-2 cities to invest in for 2026–2030.

Why Tier-2 Cities Are the Next Big Opportunity

Tier-2 cities offer the perfect balance of affordability, growth potential, and livability.

Key reasons investors are bullish:

Lower entry prices compared to metros

Rapid infrastructure development

Government focus on smart cities

Expanding IT, manufacturing & startup ecosystems

Rising housing demand from local professionals

These cities are transitioning from regional hubs into future urban powerhouses.

1. Indore (Madhya Pradesh)

Indore continues to rank high on livability and cleanliness, making it a strong long-term bet.

Why invest:

Consistent infrastructure upgrades

Growing commercial & educational ecosystem

Affordable residential prices

High end-user demand

Best for: Long-term appreciation & end-use investment

2. Lucknow (Uttar Pradesh)

Lucknow is rapidly transforming into a major real estate destination in North India.

Growth drivers:

Metro expansion & expressway connectivity

IT parks and commercial zones

Smart city initiatives

Rising demand for gated communities

Best for: Early-stage investors seeking appreciation

3. Jaipur (Rajasthan)

Jaipur’s real estate market is evolving beyond tourism.

Key advantages:

Industrial corridors & SEZs

Strong road & airport connectivity

Growth in education and IT sectors

Increasing demand for plotted developments & villas

Best for: Mixed-use and residential investments

4. Coimbatore (Tamil Nadu)

Coimbatore has emerged as a preferred city for professionals and retirees alike.

Why Coimbatore stands out:

Manufacturing & textile industry base

Pleasant climate & quality lifestyle

High demand for independent homes

Stable rental market

Best for: Rental income and end-use properties

5. Bhubaneswar (Odisha)

Bhubaneswar is quietly becoming an eastern India real estate hotspot.

Growth factors:

Smart city development

IT & government employment hubs

Affordable property prices

Increasing migration from nearby regions

Best for: Budget-friendly long-term investments

6. Chandigarh Tricity (Mohali & Zirakpur)

The Tricity region is seeing rapid real estate expansion.

Investment appeal:

Strong demand from IT professionals

Excellent social infrastructure

Premium gated community developments

Stable appreciation trend

Best for: Residential apartments & rental income

7. Surat (Gujarat)

Surat’s strong industrial economy makes it a solid Tier-2 investment destination.

Why investors are interested:

Diamond & textile industry dominance

Rising commercial activity

Infrastructure-driven growth

Affordable housing demand

Best for: Commercial & residential investment

Key Trends Shaping Tier-2 City Growth (2026–2030)

Expansion of highways, airports & rail connectivity

Rise of remote & hybrid working culture

Growth of affordable and mid-segment housing

Demand for gated communities & lifestyle projects

Increased institutional and developer interest

Investment Strategy for Tier-2 Cities

To maximize returns:

Enter early in developing micro-markets

Focus on infrastructure-backed locations

Prefer reputed developers

Invest with a 5–10 year horizon

Balance between rental yield and appreciation

Tier-2 Cities vs Tier-1 Cities

| Factor | Tier-1 Cities | Tier-2 Cities |

|---|---|---|

| Entry Cost | Very High | Affordable |

| Growth Potential | Moderate | High |

| Rental Yield | Stable | Improving |

| Risk Level | Lower | Moderate |

| Long-Term ROI | Slower | Faster |

Final Thoughts

Between 2026 and 2030, Tier-2 cities will be the biggest real estate growth engines in India. Investors who act early can benefit from lower acquisition costs, strong appreciation, and rising rental demand.

Whether you’re a first-time investor or looking to diversify beyond metro cities, Tier-2 markets offer compelling opportunities with long-term rewards.