Real Estate Appreciation Cycles Explained: A Smart Guide for Property Buyers & Investors

Real estate is one of the most powerful wealth-building assets—but only when buyers understand how property prices move over time. Knowing real estate appreciation cycles helps investors buy at the right stage, reduce risk, and maximize long-term returns.

In this SEO-focused guide, Sapphirre Realty, a trusted real estate company in Gurgaon, explains how real estate appreciation cycles work and how buyers can use this knowledge to make smarter decisions in India’s evolving property market.

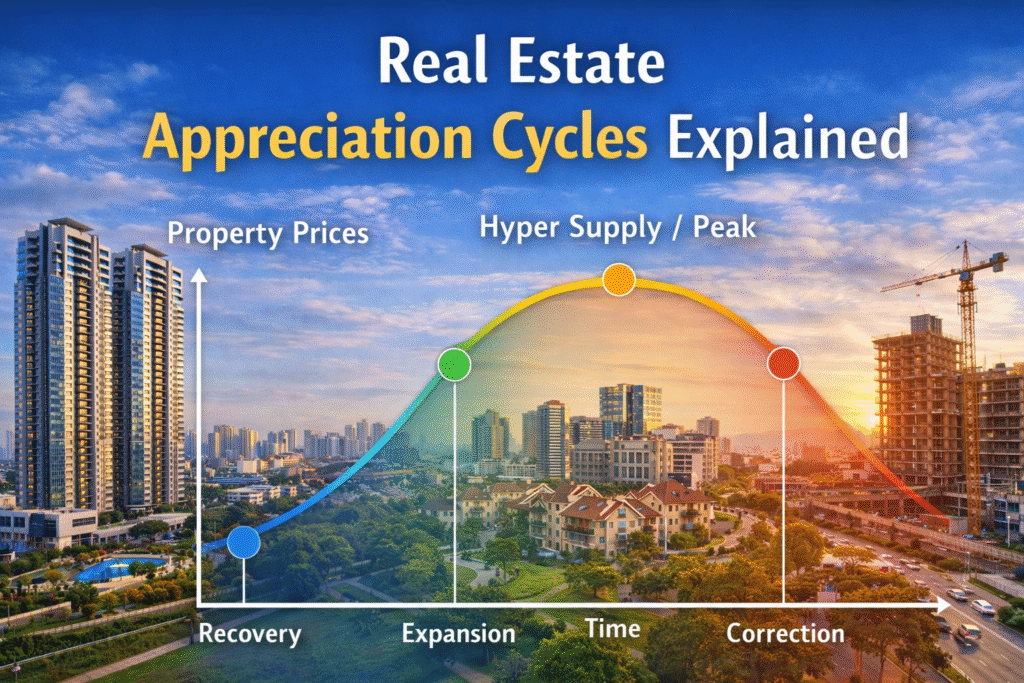

What Is a Real Estate Appreciation Cycle?

A real estate appreciation cycle refers to the natural phases through which property prices move over time. These cycles are influenced by factors such as economic growth, infrastructure development, demand-supply balance, interest rates, and buyer sentiment.

Property prices rarely grow in a straight line. Instead, they follow a cyclical pattern that repeats over years.

The 4 Key Stages of Real Estate Appreciation Cycles

1. Recovery Phase

This phase begins after a slowdown or correction.

Key characteristics:

Property prices stabilize

Sales volume starts improving

Infrastructure announcements increase confidence

Smart investors begin entering the market

👉 Best time for early investors to buy at lower prices.

2. Expansion Phase

This is the strongest growth phase in the cycle.

What happens here:

Demand rises sharply

New project launches increase

Property prices appreciate steadily

End-users and investors both actively buy

👉 Ideal phase for capital appreciation and wealth creation.

3. Hyper Supply / Peak Phase

Prices reach their highest point in this stage.

Signs of a peak market:

Rapid price hikes

Oversupply of inventory

Speculative buying

Reduced affordability for end-users

👉 Investors should be cautious and focus on exit strategies.

4. Correction Phase

Market slows down and prices either stagnate or correct.

What to expect:

Fewer buyers

Developers offer discounts or flexible payment plans

Rental demand stays relatively stable

Market prepares for the next recovery phase

👉 Long-term investors prepare for the next buying opportunity.

Why Understanding Property Cycles Is Crucial

Understanding real estate appreciation cycles helps buyers:

Avoid overpaying at market peaks

Enter markets early for maximum returns

Identify undervalued locations

Plan exits strategically

At Sapphirre Realty, a top real estate company in Gurgaon, clients are guided to invest based on market timing, location fundamentals, and long-term growth potential, not hype.

How Real Estate Cycles Apply to Gurgaon

Gurgaon has witnessed multiple appreciation cycles over the last two decades.

Why Gurgaon performs strongly across cycles:

Strong corporate and employment base

Continuous infrastructure upgrades

High rental demand

Limited premium land supply

Strong end-user and investor confidence

Micro-markets like Dwarka Expressway, Golf Course Extension Road, SPR, and New Gurgaon are currently moving through strong expansion phases, offering excellent growth opportunities.

Factors That Influence Real Estate Appreciation Cycles

Several factors impact how fast and how strongly a cycle moves:

Infrastructure development

Interest rate changes

Government policies & RERA compliance

Economic growth & job creation

Population migration & urbanization

Buyer affordability

A professional real estate company in Gurgaon analyzes these factors before advising buyers.

When Is the Right Time to Invest?

The best investment opportunities usually arise:

At the end of correction phase

During early recovery

In underdeveloped but infrastructure-backed locations

This is where expert guidance becomes crucial. Sapphirre Realty helps buyers identify the right phase and right project to ensure long-term appreciation with minimal risk.

Real Estate vs Other Asset Classes

Unlike stocks or crypto, real estate:

Is less volatile

Offers tangible ownership

Provides rental income

Acts as a hedge against inflation

Builds long-term wealth steadily

This is why property remains a preferred asset for Indian investors across generations.

Final Thoughts

Understanding real estate appreciation cycles empowers buyers to make informed, profitable decisions rather than emotional ones. Whether you’re a first-time buyer or a seasoned investor, timing your entry based on market cycles can significantly improve returns.

Partnering with a top real estate company in Gurgaon like Sapphirre Realty ensures you invest with clarity, confidence, and long-term vision.

📞 Connect with Sapphirre Realty today to explore high-growth real estate opportunities and invest at the right stage of the market cycle.